Evergrande Default Impact

Year-to-date Evergrande shares have lost 85 percent of their value as the company dropped hints that all was not well. In October 2019 China Evergrande Groups first project in Hong Kong got off to a flying.

Fitch Warns Evergrande Default Could Have Broad Economic Impact On China Aws For Wp

We believe a default would reinforce credit polarisation.

Evergrande default impact. Things came to a head in September when credit rating agencies signaled they had lost faith in Evergrandes ability to resolve its cash flow issues. Since China is considered to be the second-largest economy globally if one of its biggest real estate companies defaults it may have repercussions on the global demand and supply of various commodities. Market braces for impact of Evergrande default.

A looming debt default by Chinese real estate titan Evergrande is sparking fears of global contagion and knocking stocks from their perches. The third of a three-part series on China Evergrande Group takes a deep dive into how the property developers debt crisis is affecting thousands of suppliers across the construction furnishings and real estate services sectors and how the fallout of an Evergrande collapse could affect Chinas economy. Evergrandes cashflow troubles foreshadow what could go wrong for liquidity.

China Evergrande Group is deeply in the red to the tune of 300bn. An Evergrande Group default could expose numerous sectors to heightened credit risk another rating agency Fitch said in a note late on Tuesday but it added the overall impact. And concerns are mounting that if it defaults on its debt it could spell disaster for Chinas property market and send.

Should Evergrande default there may be contagion effects for other developers home prices and the economy. Growing fears of China Evergrande defaulting rattled global markets on Monday as investors worried about the potential impact on the wider. An Evergrande default if it does happen could affect crypto markets although how much by depends on who you ask.

On September 14 Evergrande announced that it had brought on financial advisers. Evergrande collapse could hurt the supply chains. 5 hours agoEvergrande appears set to survive another round of default fears as the distressed property giant managed to make overdue payments to holders of offshore dollar bonds.

China S Evergrande Default Risks Spook Global Markets Business Economy And Finance News From A German Perspective Dw 20 09 2021. Evergrande is once again warning that it could default on its huge debts as it struggles to cut costs or find anyone to buy some of its assets. Evergrande raises 15 billion as another debt payment looms.

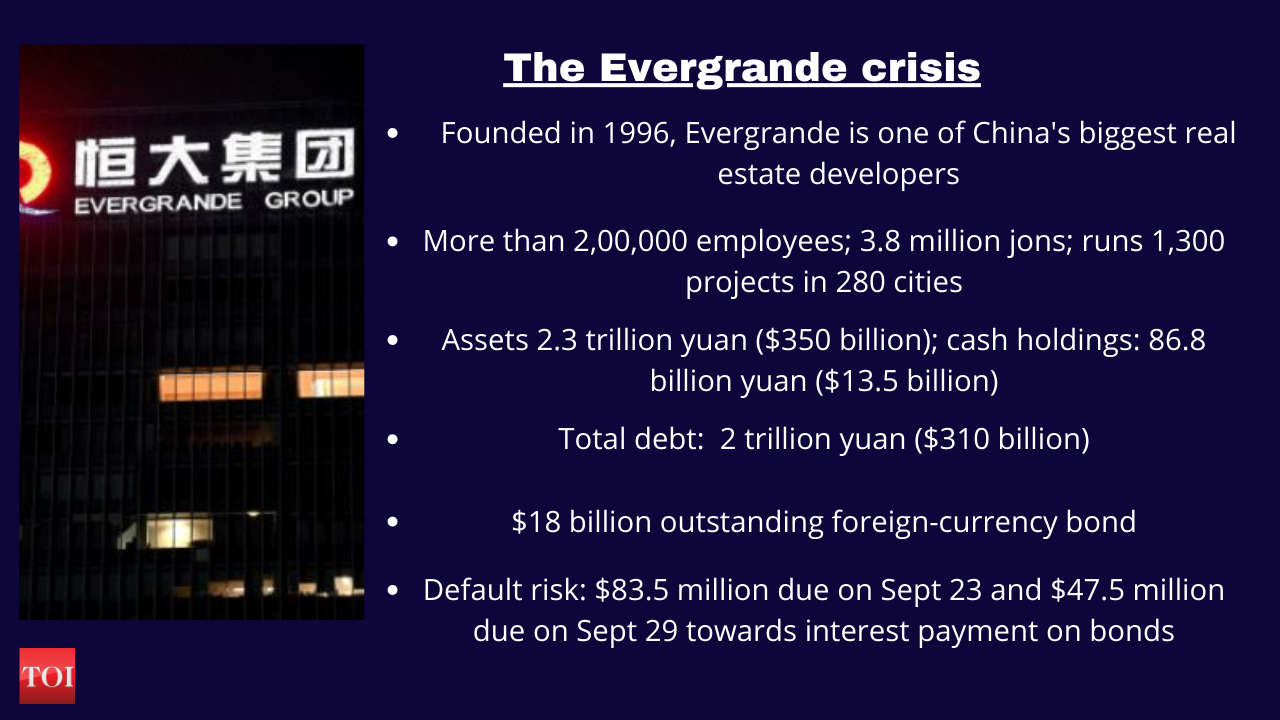

Founded by the former Chinese steel executive Xu. Ratings agency SP Global called the property developers default a. A default in the company will impact China domestically because Evergrande has about 2 trillion yuan worth of assets which is equivalent to almost 2 of Chinas GDP.

Tue 14 Sep 2021 - 940 PM ET. After missing four payments the company made a key payment to bond holders staving off default. It has been joined by other companies but Evergrande is the largest real estate developer in trouble by far.

EVERGRANDE UPDATE - Bond Default Creditors Paid in Property Current Trading Global Market Impact. Steel tiles sanitaryware and electrical items could become costlier for India. Questions loom about a government bailout and whether Evergrande is in fact too big to fail.

China Evergrande potential shocks in India. On its own a managed default or even messy collapse of Evergrande would have little global impact beyond some market turbulence. Evergrande Real Estate or Heng Da Group in Chinese owns more than 1300 building projects in more than 280 cities across China.

In other words its difficult to say exactly what effect it may have. Crisis at Chinese property developer threatens the bond market housing market and wider economy. The danger is precisely the contagion effect should a default occur without clear ring-fencing of spillovers to other parts of the real.

Numerous sectors could be exposed to heightened credit risk if Chinese property developer Evergrande were to default says Fitch Ratings. As the company struggled to repay creditors global markets responded with selloffs. China Evergrandes debt pile dwarfs the annual gross domestic product GDP of several nations including Sri Lanka Luxembourg and Croatia and it looks increasingly likely to miss interest payment due on 20 September.

GST rate for construction and building materials Regulatory learnings from Evergrande default. Credit Event at Chinas Evergrande Could Have Broader Effects. Market Spotlight China Evergrande.

Fitch Ratings-Hong KongShanghai-14 September 2021. Fear contagion from the Evergrande crisis warns. Evergrande Payment Deadline Imminent.

This is how the Evergrande crisis will impact India. Investors assess risks of likely default. Evergrande narrowly missed default on some foreign-owned debt this week as it teeters on the edge of insolvency from the domestic real estate slump according to the New York Times.

Evergrande is Chinas second-largest real estate company. As the debt default has not occurred all we can do is look at it through a range of. Evergrande Deep Dive What Impact Could A Default Have On Your Crypto By T C Gunter Predict Sep 2021 Medium.

China S Evergrande In Uncharted Waters After Key Interest Deadline Passes News Dw 24 09 2021

Evergrande S Rising Default Risk All You Need To Know Times Of India

Explainer How China Evergrande S Debt Troubles Pose A Systemic Risk Reuters

What Would An Evergrande Default Look Like The New York Times

Evergrande Default Could The Property Giant S 250 Billion Debt Spark A Global Financial Crisis Euronews

As Evergrande Default Looms What Legal Options Do Offshore Creditors Have Euronews

Evergrande Avoided Default In The Last Minute R Cryptocurrency

Evergrande Deep Dive What Impact Could A Default Have On Your Crypto By T C Gunter Predict Sep 2021 Medium

An Evergrande Default Could Reset The Chinese And Global Economy Icis

China S Evergrande Default Risks Spook Global Markets Business Economy And Finance News From A German Perspective Dw 20 09 2021

What Is The Evergrande Debt Crisis And Why Does It Matter For The Global Economy World Economic Forum

Evergrande Not Too Big To Fail China Can Manage Its Collapse Enodo Asia Financial News

Evergrande Averts Default With Interest Payment Reports Evergrande The Guardian

China S Evergrande Default Risks Spook Global Markets Business Economy And Finance News From A German Perspective Dw 20 09 2021

Fitch Warns That Evergrande Defaults Could Have Economic Benefits For China As A Whole Jioforme

Evergrande Debt Crisis Bond Default Impact On Indian Real Estate Buying Luxury Property